Online wallet is the next best option after cash for small expenses. After govt demonetisation move, its gaining momentum for daily expenses. There are several offers rolled out by many online wallet providers, read more to know about online wallet and their offers.

Latest offline offer via wallet payment

- 15% Cashback in KFC outlet via Paytm wallet

- 15% Cashback in Heritage supermarket via Freecharge wallet

- Share offers from your neighbourhood, message me on facebook

How to pay offline via wallet?

Provide your mobile number to merchant, you will receive OTP shortly, provide OTP, done. You will receive for the payment made. You don't need smartphone or internet connection.

What is online wallet or e-wallet?

Its same as your bank account accessible anywhere and accepted by many merchants. It has less restriction then bank account. You can add money to online wallet from bank account, via net banking, credit card, debit card or direct bank deposit in some cases. Online wallet became popular with mobile recharge offers initially.

Online wallet features?

Online wallets features are as follows..

- add money to wallet from any source.

- transfer money back to bank account.

- transfer money to friends online wallet account.

- pay to merchants without any pos machine.

- primarily used for mobile recharges.

- no physical hardware required to make payment except your mobile.

- enjoy regular offers.

- Accepted by 100’s of merchants across India.

- Limited liability, easy returns for transaction failures.

- Transaction history.

Type of online wallet?

There are basically two types of online wallet. First is what I explained earlier where you keep some money for purchase, recharge, transfer etc. Second type of wallet holds details about your credit card, debit card, loyalty cards, discount cards, gift cards etc , so you don’t need to carry them everywhere with you. This online wallet is not popular in India. Google wallet is such type of online wallet.

Limitations of online wallet, how much you can transact via online wallet?

Unlike bank account, here there is transaction limit of Rs. 10,000/- without kya, after kya Rs 100,000/-. This means you can have upto the limit balance. This is to limit loss in case of fraud.

How to use online wallet?

There are two popular ways to use online wallet.

Offline Payment - You will need to provide your mobile number associated with online wallet to start the transaction and then OTP/pin to complete the transaction.

Offline Payment - You can scan merchant QR code, enter amount and pay.

Online Payment - Online wallet can be used same as any other payment option.

Benefits of online wallet over debit/credit card?

Wide acceptance, from local merchants to online portal such as irctc. Limited liability. Avoid loss or theft of card. No pos machine required to complete transaction. No chance of card duplication or pin theft.

Virtual credit/debit cards by freecharge?

Freecharge provides virtual debit card with YES bank which can be used for online shopping. Before using this card, you need to add money in your free charge wallet.

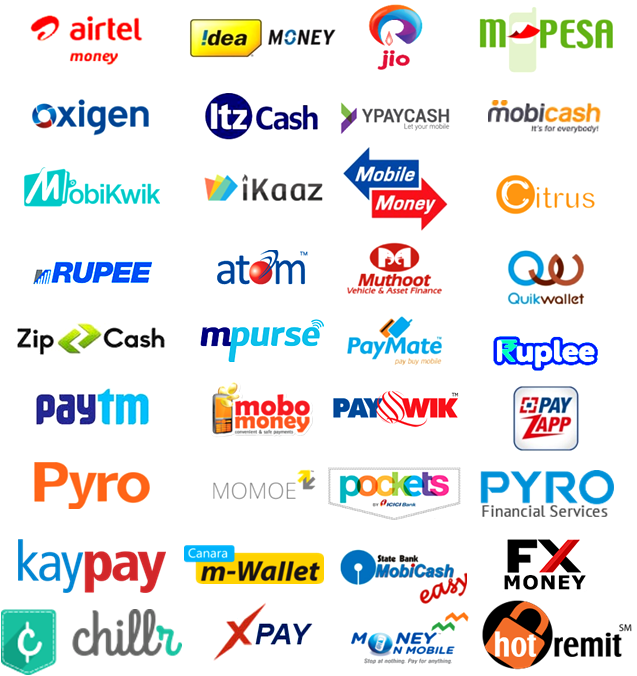

Online wallet providers?

Paytm, Freecharge, Idea, Airtel Money, Oxigen wallet, PayZapp, Icici Pocket etc.

|

| Online wallet |

Online wallet offers?

Freecharge wallet offers

Paytm Wallet Offers

Online wallet usages /coverage , the places where they can be used?

Online wallet can be used for both offline shopping as well as online shopping. Every popular merchant usages at least one online wallet for payments.

How to look for online wallet offers?

Its very simple, you should simply search for "Paytm wallet offer" or "Freecharge wallet offer" , similarly for any provider offer.

Most important links to check next ...

See Also: How to know, if you have already applied promocode

Still not on uber: 3 Free Rides Promo Code for New Sign up

Still looking for ideas: 7 ways to save money while shopping online